Everything is fine

If you’re of a certain zoomer-ish age (born between ‘97 and ‘02?), you grew up in global financial crisis and haven’t known much else since. The great recession likely colors some of your earliest memories. For many of you, becoming conscious of the big cruel world started with an axiomatic lesson: Inside of tall buildings, there are men in suits whose job is to move around abstractly-large sums of money; sometimes, they do irresponsible, greedy things with that money — things that make it harder for the rest of us to own homes or eat dinner out; it is normal and popular to be mad at them for this.

I read Michael Lewis’s¹ 2010 book The Big Short in hopes of getting a more sophisticated understanding of all that (with a more pleasurable reading experience than, for example, the Wikipedia article on the subprime mortgage crisis). Ultimately, the childhood lesson still basically checks out. In Lewis’s account, the housing bubble was the financial scam of the century, and it went something like this:²

- Wear a suit inside a tall building.

- Convince all your clients that mortgage-backed securities — traded aggregations of mortgages typically classified by their risk rating (i.e. their likelihood of default) — are the most reliable investment on the market, better than U.S. treasury bonds.

- Sell a shitload of mortgage-backed securities and get rich.

- When you run out of low-risk mortgages purchased by wealthy people with good credit, start securitizing high-risk subprime mortgages purchased by poor people with bad credit.

- To trick investors into buying these bad, high-risk mortgages, pile them all up into a new third thing, called a collateralized debt obligation, and then dupe the rating agencies into telling everyone that they are actually good, low-risk mortgages. (This will have the added affect of incentivizing predatory lenders to make even more subprime mortgages, since the appetite of investors willing to finance them will appear endless.)

- Sell a shitload of collateralized debt obligations and get even richer.

- Repeat. You can even make something called a “CDO-Squared”: a collateralized debt obligation composed of other collateralized debt obligations.

Lewis seems to think most of the mortgage bond guys were stupid, indifferent, or both.³ When poor people with bad credit began to default on their loans in 2007, the guys wearing suits in tall buildings all behaved like they were more-or-less surprised about it.

Anyway, here’s this from the Wall Street Journal on Wednesday:

Goldman Sachs this month sold $475 million of public asset-backed securitization, or ABS, bonds backed by loans the bank makes to fund managers that tide them over until cash from investors comes in. The first-of-its-kind deal is a lucrative byproduct of the New York bank’s push into loans to investment firms, such as these so-called capital-call lines …

Bankers say the capital-call ABS and similar innovations help them safely serve clients while bringing in rich fees. But such efforts have preceded market excess in the past, to put it mildly. Skeptics see parallels between CDOs (the collateralized debt obligations that helped fuel the financial crisis in 2008) and the growing use of SRTs (synthetic risk transfers), NAV loans (based on net asset values) and more.

The transactions are relatively small for now. Still, they are intertwining banks (in Wall Street parlance, the sell side) with investors (the buy side) in ways that are new and difficult to parse for analysts, regulators and others.

Is Matt Wirz explicitly analogizing the private equity-ization of the entire American economy to the quasi-fraudulent credit regime of the pre-recession housing bubble? Well yes. But what if we meritocratized it though?

A group of lawmakers has proposed legislation that would allow any investor capable of passing an exam to buy private securities—an array of investments like shares in pre-IPO startups or loans to private companies that are considered riskier because they have looser disclosure rules than public securities and can be harder, and sometimes impossible, to sell in a pinch.

The idea is that the ability to make these high-risk, high-reward bets should be open to all sophisticated investors, not just those with the biggest bank accounts …

Investor-protection advocates say changing that rule would water down necessary safety guards for individual investors while lining the coffers of private companies and Wall Street firms.

Hi everyone. It’s been a few months. Things are going fine.

This week in Capitalism Breeds Innovation

Johnson and Johnson is set to surpass $1 billion in ketamine sales. McKinsey is set to lose another $500 million in opioid lawsuit settlements. About one-fourth of Syria’s GDP is generated by Assad's side-hustle selling speed. TikTokers are shilling anti-aging supplements using AI-generated pro-North Korea propaganda. Big Food Is Learning to Love Weight-Loss Drugs [sic]. And embryo-screening startup Heliospect Genomics is doing “liberal eugenics.”

The footage appears to show experimental genetic selection techniques being advertised to prospective parents. A Heliospect employee, who has been helping the company recruit clients, outlined how couples could rank up to 100 embryos based on “IQ and the other naughty traits that everybody wants”, including sex, height, risk of obesity and risk of mental illness …

In future, he speculated, the offering might be extended to include personality types, including providing scores for what he called the “dark triad” traits. Dark triad is normally a reference to machiavellianism, narcissism and psychopathy. Christensen said it might also be possible to develop scores for depression and creativity. “Beauty is something lots of people actually ask about,” he added.

Meanwhile, Google’s search engine is systematically regurgitating debunked IQ pseudoscience, linking directly to the race scientists who propagate it on X, The Everything App.

Some completely innocent Harvard students innovated a technology which will enable perverts to more quickly find the identities of women they stalk online, which is not something a Harvard student has ever done before. And Roblox (NYSE:RBLX) has innovated “an X-rated pedophile hellscape.”

By merely plugging ‘adult’ into the Roblox search bar, we found a group called “Adult Studios” with 3,334 members openly trading child pornography and soliciting sexual acts from minors.

We tracked some of the members of “Adult Studios” and easily found 38 Roblox groups – one with 103,000 members – openly soliciting sexual favors and trading child pornography.

Registered as a child, we were also able to access games like “Escape to Epstein Island” and “Diddy Party”. We found over 600 “Diddy” games, including “Survive Diddy” and “Run From Diddy Simulator”.

Lina Khan had two top-40 hits in the past few weeks, banning both impossible-to-cancel subscription services and fake online reviews. We stan. America’s largest entertainment and telecom trade groups immediately opted to sue Khan’s FTC over the new “click-to-cancel” rule because it is “overly broad.” We do not stan.

The Irish Data Protection Commission also landed a one-two punch with a $103 million fine on Meta for inadequate password security measures and then another $330 million on LinkedIn for non-consensual targeted advertising practices. Elon Musk, in the meantime, innovated the final boss of targeted advertising. And the rest of Silicon Valley innovated Donald Trump’s second presidential campaign.

This week in Things That Are Not F******

In the New York Post, Rich Lowry decried Kamala Harris’s use of a “tired slur” in reference to two-time assassination attempt target Donald Trump.

The F-word is one of the left’s favorite swear words, and applying it to Trump must be emotionally satisfying, whether it makes any sense on the merits or politically.

On the same day, the Associated Press published an explainer with the headline “What is f******? And why does Harris say Trump is a f******?” We’re still not entirely sure, but we’re looking forward to listening and learning. Whatever it is, it’s definitely not this:

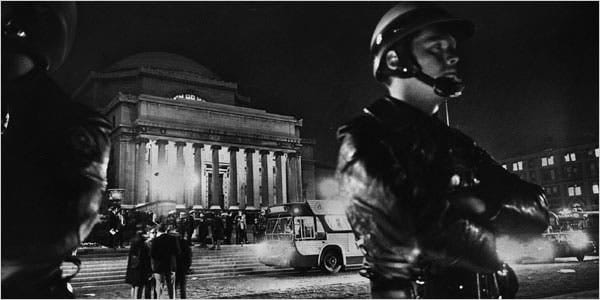

Last night, Trump’s campaign hosted a rally at Madison Square Garden, in New York City, that was marked by a string of overtly racist and extreme statements; as the New York Times noted, one speaker, a podcast host and so-called comedian, “kicked off the rally by dismissing Puerto Rico as a ‘floating island of garbage,’ then mocked Hispanics as failing to use birth control, Jews as cheap and Palestinians as rock-throwers, and called out a Black man in the audience with a reference to watermelon.” As the event progressed, headlines in a number of major outlets characterized the rhetoric at the rally in notably sharp language, though this wasn’t universal. (Online, one observer characterized a USA Today headline about Trump’s “closing pitch” as being not so much “sanewashing” as “sane sandblasting.”)

Also this week in Things That Are Not F******: Wall Street Journal columnist argues that increasing domestic manufacturing productivity is an urgent national security concern which warrants substantial government intervention (because China). The militaries of North Korea and Russia are linking up to optimize operational synergy. And person of far-right experience Vladimir Putin is in talks on how best to maximize his joint slay with person of caucasian South African experience Elon Musk.

The Attorneys General of Kansas, Missouri, and Idaho would like the FDA to please reconsider banning abortion drug Mifepristone because studies show it is “depressing expected birth rates for teenage mothers in Plaintiff States.” Maintaining the current rate of teen pregnancy is important because the alternative is a “reduction in the actual or potential population of each state,” which could result in “diminishment of political representation” or “loss of federal funds.” That’s bad news for the reproductive healthcare industry. But it’s great for the direct-to-law-enforcement warrant-free location-tracking adtech industry.

This week in Hyper-Local AI Podcasting

In Melrose, Massachusetts, an experiment in hyper-local AI podcasting:

Catalini sighs describing the Melrose news options over the 25 years since he moved with his wife to the city, which felt “robust” at the time. Now, almost nobody is covering hyper-local news like override votes or digging into the overwhelming documentation around proposed zoning policy, he said.

“In a way, what I’m talking about is an act of desperation,” he said of the Robocast.

Gallup: In general, how much trust and confidence do you have in the mass media? Pew Research Center: How much, if at all, do you trust the information you get from national news organizations? Also Pew Research Center: Overall, do you think X (formerly Twitter) is mostly good for American democracy? Nieman Journalism Lab: Why do news anchors look like that? Charlotte Klein: Who will be the Walter Cronkite of YouTube?

This blog is not a media business. It’s a hobby, and as such, it’s free. If you’re suddenly stricken with the irresistible impulse to make micropayments to an online entity, I’d suggest either Wikipedia or the Internet Archive. Both are going through it right now, and both have FTC-compliant subscription models.

Here’s Naomi Klien on memorializations of October 7th. And here’s the conservative estimate of deaths, injuries, illness, and infrastructure destroyed in Gaza since then. Happy Monday and happy Halloween. Do yourself a favor and log off for the week.

¹ Lewis is also the author of Moneyball and The Blind Side, both of which became Hollywood hits as well. There’s currently some ongoing drama between Michael Oher, The Blind Side’s IRL protagonist, and the Tuohy family, who apparently did not actually adopt him IRL. The litigation has resurfaced a deluge of “Michael Lewis lowkey racist” allegations. Here’s a peak:

Passages of the book now read as off-key. In characterizing Oher’s otherness at the wealthy and almost all-white Briarcrest school, Lewis describes him, variously, as “this huge Black kid” and “as lost as a Martian stumbling out of a crash landing.” His mother, Denise Oher, is “very large and very Black,” and in a brief meeting with her son Michael and Leigh Anne, she slurs her words and wears a “muumuu and a garish wig.” Sean Tuohy, who pitched in as an assistant football coach at Briarcrest, is credited by Lewis with a magical ability to instill confidence in teenage boys. He was said to reach out especially to the school’s few Black athletes. “I married a man who doesn’t know his own color,” he quotes Leigh Anne as saying.

To my knowledge, Moneyball is not very racist.

² I do not have a background in finance. If you feel I have misexplained or omitted information to the degree that it represents a matter of urgent importance to the public, I welcome constructive feedback: lexmoul@protonmail.com

³ Interestingly, Lewis is comparatively credulous about friend of the blog Sam Bankman-Fried.